The Bank of Ghana (BoG) has urged the public to disregard reports that it has been gutted by fire.

The bank in a statement issued on Facebook said it had taken note of reports circulating on social media that the Bank has been gutted by fire.

Instead, the bank said it conducted a routine fire drill (simulation exercise) today to prepare staff for a real-time fire situation.

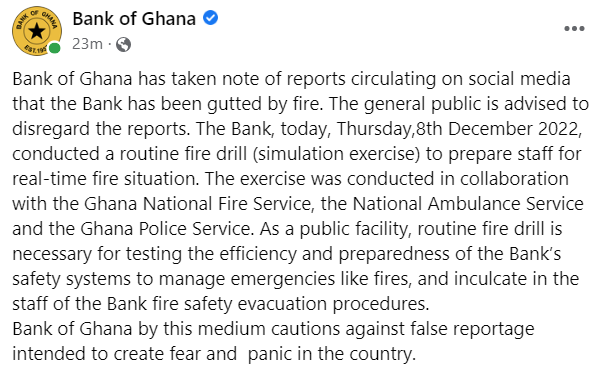

The BoG's Facebook post read: "Bank of Ghana has taken note of reports circulating on social media that the Bank has been gutted by fire. The general public is advised to disregard the reports. The Bank, today, Thursday,8th December 2022, conducted a routine fire drill (simulation exercise) to prepare staff for real-time fire situation. The exercise was conducted in collaboration with the Ghana National Fire Service, the National Ambulance Service and the Ghana Police Service. As a public facility, routine fire drill is necessary for testing the efficiency and preparedness of the Bank’s safety systems to manage emergencies like fires, and inculcate in the staff of the Bank fire safety evacuation procedures.

Bank of Ghana by this medium cautions against false reportage intended to create fear and panic in the country".

Meanwhile, the Ministry of National Security had earlier announced that it would, from last Tuesday, December 6, 2022, to Thursday, December 8, 2022, conduct a series of simulation exercises in the Savannah, Oti, and Greater Accra regions.

The exercise, dubbed EXERCISE HOMESHIELD-2022 is part of measures to enhance the capacity of security personnel to respond adequately to the country’s constantly evolving threat landscape.

Specific details of the exercise would be communicated to residents of areas to be directly impacted through the various District Security Councils. That notwithstanding, the general public is duly informed and urged to cooperate with the various security personnel to ensure law, order and public safety throughout the conduct of the exercise," the Ministry said in a statement issued on December 1, 2022.

Read the BoG posts below;

Comments