The Ghana Union of Traders Association (GUTA) and the Association of Ghana Industry (AGI) are calling on regulators of the financial sector to do more to protect the investments of Ghanaians.

The two associations are of the view that if confidence and trust would return to the capital market, the Bank of Ghana and the Securities and Exchange Commission (SEC) must do more in terms of regulation.

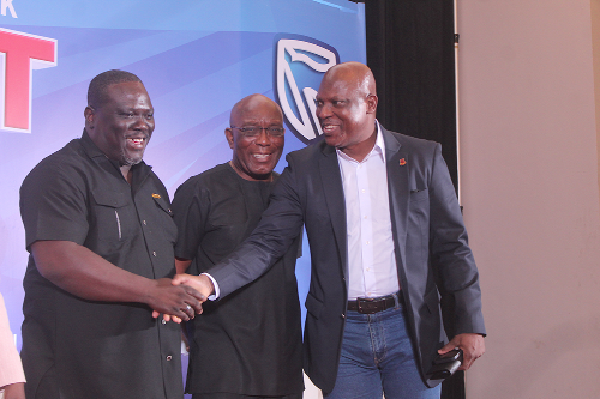

Speaking in an interview on the sidelines of the Graphic Business/ Stanbic Bank Breakfast meeting, the President of the GUTA, Mr Joseph Obeng, said the regulators must build a strong capital market that would be attractive to traders.

The breakfast meeting, which was held on the theme “Domestic Debt Exchange Programme; Lessons and Implications for How to Invest”, brought together policy makers, regulators, experts and people in academia.

All that we need is confidence in the system. We are importers and are in the informal sector but at the same time, we have to diversify our business and that is what we do in trading in the bonds through the banks.

“If it comes to a time that we cannot have the worth of our investments, then we will take back our investments and trade in what we know best,” he stated.

He continued that, “when we make investments, we expect that it is well managed. Policies should be tailored such that it will enhance investment rather discouraging the people.”

He said if the regulators do not step up their game and do more to protect the industry, the country would return to the revolutionary days where people shunned away from investing or putting their money in the bank.

Regulators must play active role

For his part, the President of the AGI, Dr Humphrey Ayim Darke, urged the regulators to play an active in deepening the capital market and restoring confidence in the sector.

He said the regulators have over the years not done enough to protect the industry, a situation which must change.

Dr Darke said the AGI welcomed the discussion that investors and financial institutions should begin to invest their money in the private sector instead of investing them in government securities.

He said the private sector was ready to take advantage of the new era and attract some of these investments to further develop.

We agree to the position of diversification of the market from traditional government instruments and looking more into the private sector but we also request that the regulators play their role in regulating the market create market opportunities for private sector to take advantage of the long term funds that are seated with the pension funds and other long term funds,” he pointed out.

Re calibrating development paradigm

The AGI President also noted that the DDEP presented an opportunity to re-calibrate our developmental paradigm to focus on investing a lot more in the private sector.

So it’s a welcoming position, as difficult as it is that we have got to this stage, taking advantage of the opportunity is the next major discussion and actualising the outcomes of this discussions,” he stated.

Comments