Spot gold was up 1.0% to $1,860.43/oz by 11:30 a.m. EDT, after reaching its highest since September 2011 earlier in the day at $1,864.90/oz. US gold futures were 1.3% higher at $1,867.40/oz in New York.

“The fact that governments, central banks and pretty much everyone else are looking to more fiscal and monetary policy inputs is helping drive the yellow metal,” Michael Hewson, chief market analyst at CMC Markets UK told Reuters.

“With equities struggling to push higher, gold is likely to test $1,900/oz over the next few days and weeks,” Hewson said, adding that “only an improvement in the pandemic situation and the economy could stop gold’s bull run.”

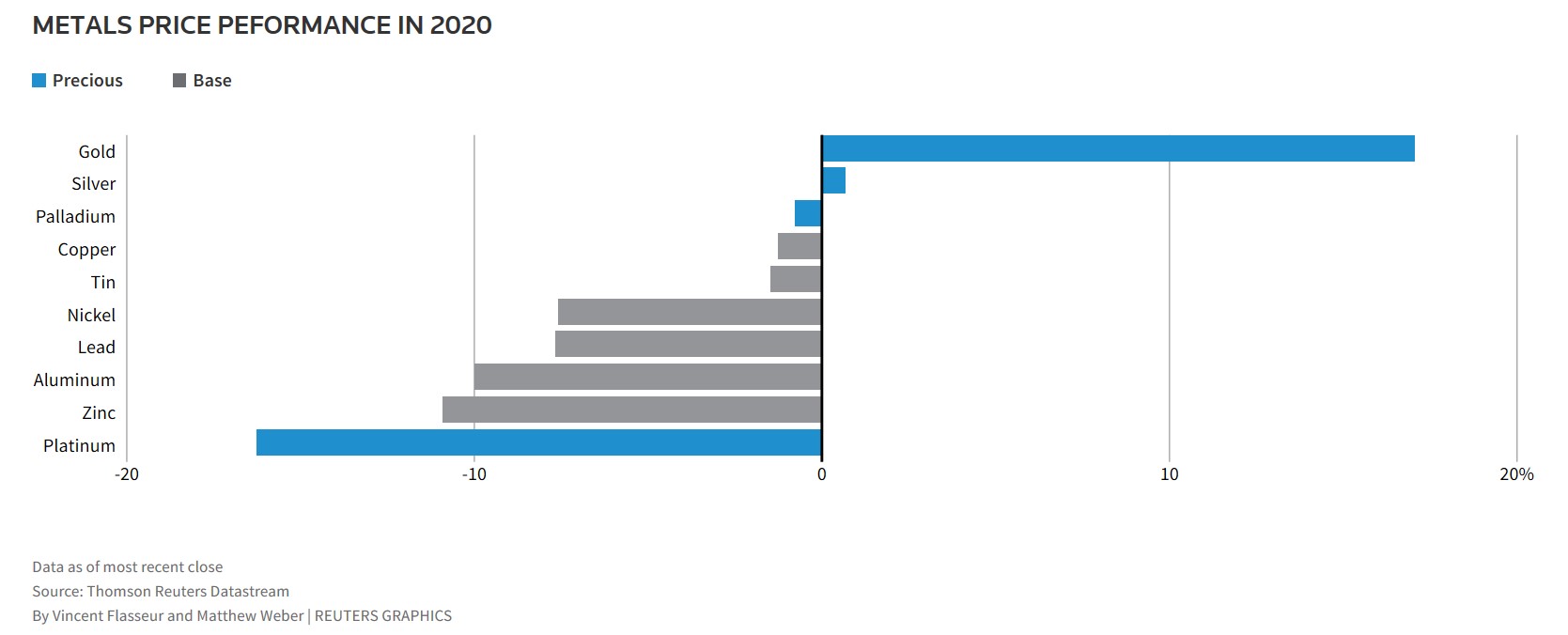

Bullion has surged nearly 22% this year and is now within $70 of an all-time high, bolstered by low interest rates and waves of government stimulus to revitalize virus-hit economies.

Deepening negative yields in the US Treasury market are fueling gold’s recent rally, with five year treasuries currently yielding -1.15% once the effects of inflation are stripped out, a seven-year low.

“Gold is a superior form of purchasing power protection and as real rates dive significantly below zero here, gold is relatively more attractive as a hedge,” said Sprott Inc. CEO Peter Grosskopf.

“The damage inflicted to the dollar as a result of fiscal spending and falling real interest rate due to monetary easing provide bullish factors for gold,” said Yuichi Ikemizu, head of the Japan Bullion Market Association. “As long as this environment continues, gold will continue to rise.”

So far this year, investors have poured record amounts into gold-backed exchange-traded funds (ETFs), increasing their holdings by 28% to more than 105 million ounces according to data compiled by Bloomberg, taking the total value to $195 billion.

Silver boon

Silver is also posting a significant bull rally as the driving forces behind gold spill into other precious metals.

Spot silver jumped more than 8% on Wednesday — the biggest gain since March — an

d has been getting an added boost from supply concerns and optimism about a rebound in industrial demand.

Trading at more than $22/oz, the spot price has gained 14% in the past week and is near a seven-year high.

Silver for September delivery also rose as much as 8.3% on the Comex to $23.35 an ounce, the highest for a most-active contract since 2013.

“In the very short-term term the direction is still upwards,” Carsten Fritsch, a Commerzbank AG analyst, said of gold and silver. “You see that prices continue to march higher. There might be some setbacks, but these are just brief and short-lived and are being used as a buying opportunity.”

Comments