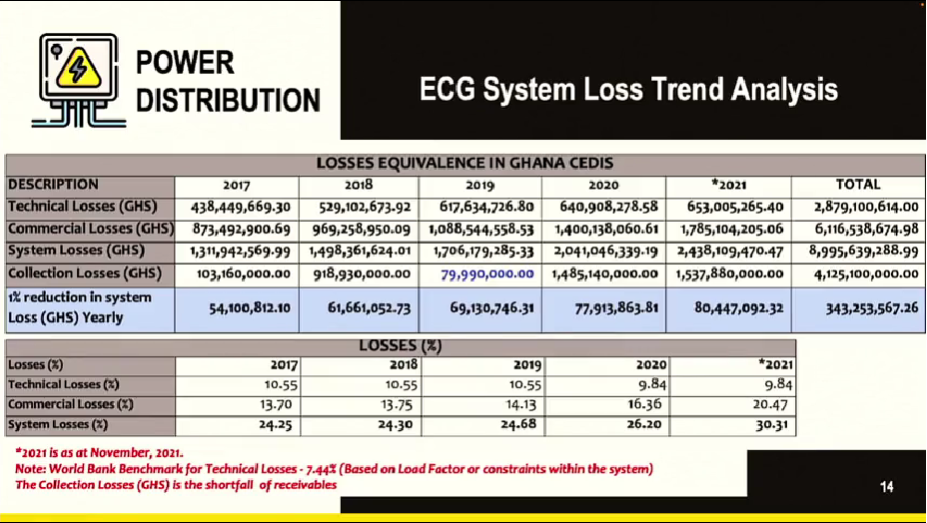

Energy Minister, Dr. Matthew Opoku Prempeh, has disclosed that the Electricity Company of Ghana (ECG) loses about $400 million to illegal connections.

Sharing the data at a press conference on Wednesday, the Minister said the amount of money ECG fails to collect is largely made up of its commercial losses and collection losses.

I mean theft; those who are stealing metres, those who are bypassing their metres, those whose metres are not working, and those who don’t even have metres but also have electricity.”

According to Dr. Opoku Prempeh, ECG would struggle to be a viable company if these illegalities, which result in accruing debts persist.

That ECG loss is our inability to pay or our willingness to pay our power theft.”

Meanwhile, the Public Relations Officer (PRO) of the Accra West Region of ECG, Mary Eshun, stated that public and private institutions that owe ECG have been served disconnection and demand notices.

According to ECG, these institutions owe an amount of ¢9,824,642.89, and thus risk being disconnected from the national grid.

These institutions are the Ministry of Communications, Kofi Annan Peacekeeping Center, United Nations Development Program (UNDP), the Economic and Organized Crime Office (EOCO), National Information Technology Agency (NITA), and the University of Professional Studies, Accra (UPSA).

But the Energy Minister was positive his Ministry does not owe any debt to ECG and does not risk being disconnected from the national grid.

The National Revenue Protection Taskforce (NRPT) would not visit the Ministry of Information very soon but would definitely visit the Ministry of Information. They have visited my Ministry, Ministry of Energy.”

He urged Ghanaians to be responsible and pay for the energy that they consume if they do not want to be visited by NRPT.

Comments