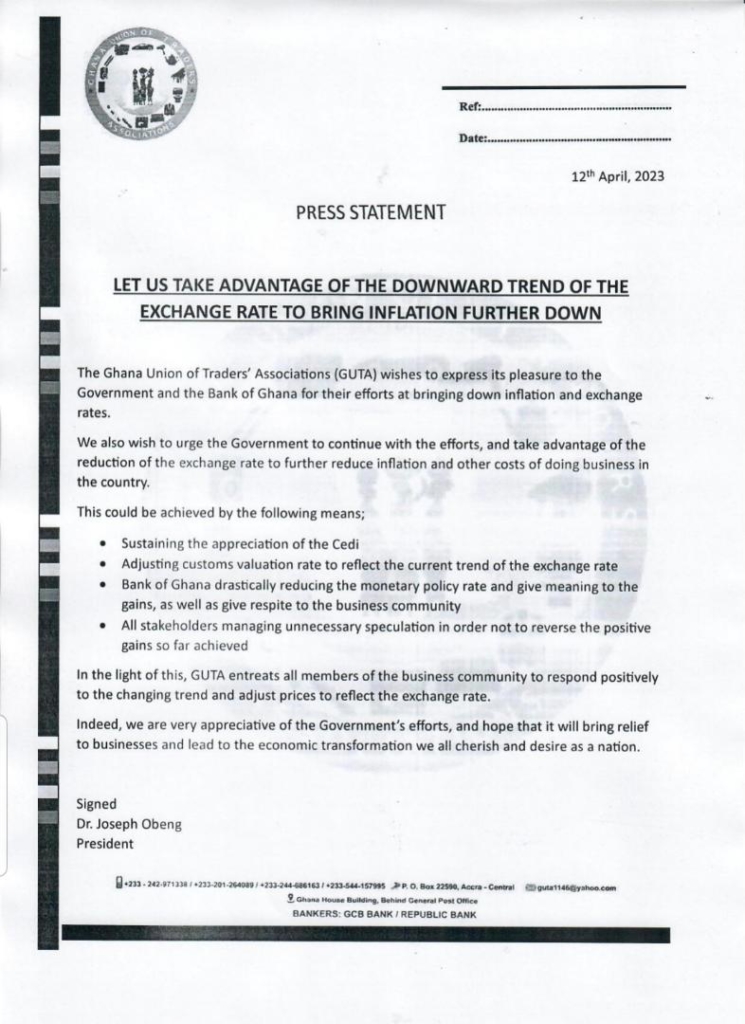

The Ghana Union of Traders Association (GUTA) has entreated its members to respond positively to the improved economic position of the country and adjust prices accordingly.

According to a statement from the traders group, efforts by the government and the Bank of Ghana to bring down inflation and exchange rate are commendable, hence the call on its members to cut prices of goods.

GUTA, entreats all members of the business community to respond positively to the changing trend and adjust prices to reflect the exchange rate. We express our pleasure to the government and the Bank of Ghana for their efforts at bringing down inflation and exchange rate”.

It urged government to continue with the efforts and take advantage of the reduction of the exchange rate to further reduce inflation and other costs of doing business in the country.

It added that this could be achieved by adjusting customs valuation rate to reflect the current trend of the exchange rate.

We wish to urge government to continue with the efforts and take the advantage of the reduction of the exchange rate to further reduce inflation and other costs of doing business. Adjusting customs valuation rate to reflect the current trend of the exchange rate”.

Last week, the cedi gained across the major trading currencies in the foreign exchange market following progress on Ghana’s negotiations with its bilateral creditors.

It gained 10.27% week-on-week against the US dollar in the retail market to close at a mid-rate of ¢10.95 to one US dollar on Thursday, April 6, 2023.

Also, inflation for March 2023 fall sharply to 45%, influenced by some deflation of items in both the Food and Non-Alcoholic Beverages group and Non-food inflation.

Below is the statement

Comments