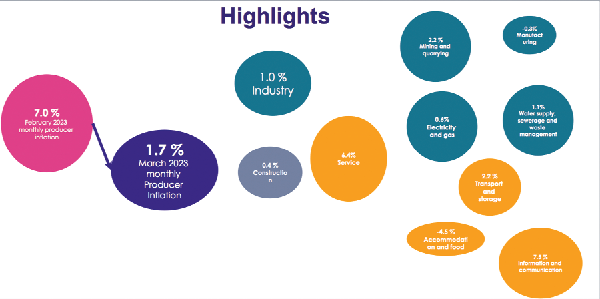

The Producer Price Inflation (PPI), which measures the average change over time in the selling prices of goods and services as received by domestic producers, has dropped to 43.7 per cent in March 2023.

The rate change represents a decrease of 6.8 percentage points as compared to the February 2023 rate of 50.8 per cent.

Analysts said this was positive news as it signals that consumer inflation may continue to drop as witnessed in the first three months of the year.

The March rate was largely driven by a drop in the industry sector which decreased from 57.9 per cent in February to 43.3 per cent in March.

This was followed by the construction sector which also saw a drop from 21.1 per cent to 18.8 per cent for the period under review.

The rate in the services sector ,however, increased from 13.4 per cent in February to 18 per cent in March.

Sector analysis

Under the industry sector, the mining and quarrying sub-sector recorded the highest year-on-year producer price inflation rate of 40.4 per cent, followed by electricity and gas with 57.5 per cent.

The manufacturing sub sector also recorded a PPI rate of 46 per cent, with the water supply, sewerage and waste management sub-sector recording the lowest PPI of 33.3 per cent.

In the mining and quarrying sub-sector, mining support service activities recorded the highest rate of 56.9 per cent in March 2023, followed by mining of metal ores (52.5 per cent).

Mining of crude oil recorded a PPI of 50.9 per cent, with extraction of crude and natural gas recording the lowest PPI of 15.5 per cent.

Under the construction sector, the construction of buildings sub sector recorded the highest PPI of 41.5 per cent.

This was followed by civil engineering (10.6 percent), with specialised construction activities recording the lowest PPI of 6.4 per cent.

Under the services sector, the transport and storage sub-sector recorded the highest year-on-year producer price inflation rate of 59.3 per cent.

This was followed by the accommodation and food sub-sector with 47 per cent.

The information and communication sub-sector recorded the lowest year-on-year producer inflation rate of 11.3 per cent.

Side bar

The Producer Price Index (PPI) measures the average change over time in the selling prices of goods and services as received by domestic producers.

Prices collected for the computation of PPI are known as factory gate prices, which are the prices firms assign to their products.

These prices exclude sales and excise taxes, government subsidies and other costs incurred by other intermediaries and consumers.

Comments