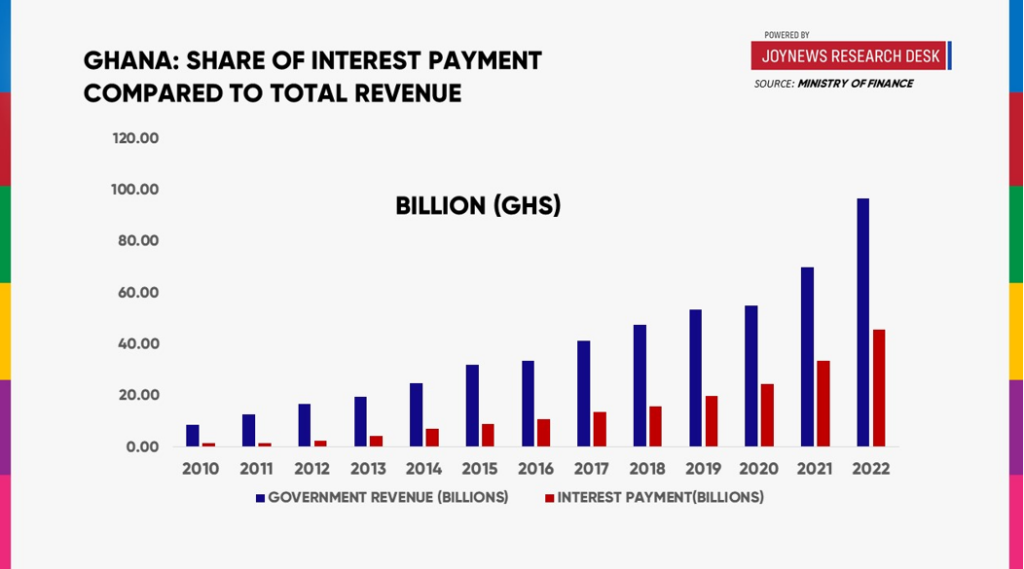

Ghana spent 42% of its revenue to servicing debt between 2017 and 2022, according to the 2024 United Nations report on Unpacking Africa’s Debt.

This marks a significant increase compared to the 2010–2016 period, during which 27% of Ghana’s revenue was used to service debt.

The 15-percentage-point rise in debt servicing from the 2010 – 2016 to the 2017 – 2022 period underscored the increased fiscal pressures the country faced.

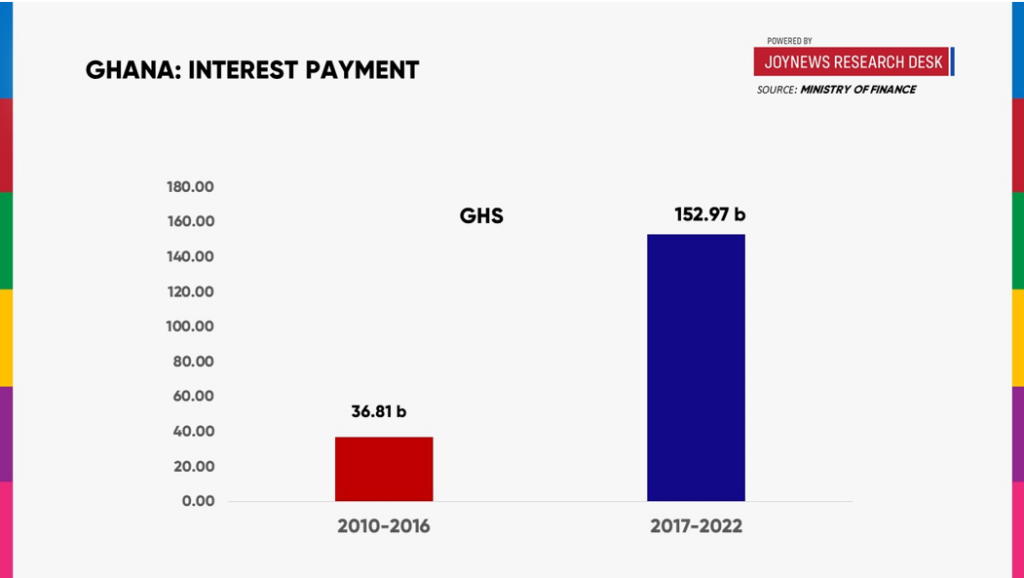

Data from the Ministry of Finance reveals a sharp escalation in interest payments over the years. While GH¢36 billion was spent on debt servicing between 2010 and 2016, the amount soared to GH¢152 billion during the 2017–2022 period.

In total, Ghana’s debt servicing between 2010 and 2022 amounted to GH¢189 billion, with a staggering 81% of that paid in the latter five years.

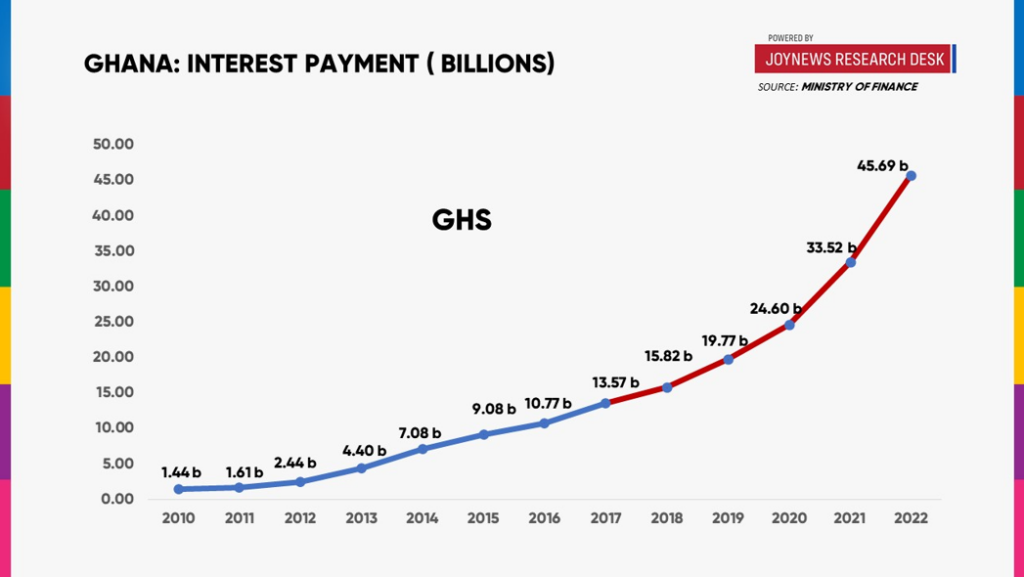

Also, within 2010 and 2022, the nation’s lowest interest payment was recorded in 2010 which is GH¢1.44 billion and recorded its highest interest payment in 2022 which is GH¢45.69 billion as per the data from the Ministry of Finance.

The 2024 United Nations report on Unpacking Africa’s Debt also identified that the steep increase in debt servicing constrained government spending on public services and eventually led to Ghana’s being classified as one of the world’s 10 most debt-distressed nations.

The IMF revealed that, in 2020, Ghana’s debt to revenue ratio reached an all-time high of 127%, the highest in Sub-Saharan Africa at the time.

Despite the debt to revenue ratio dropping to 117% in 2022, Ghana had to default on its external debts in 2022 with the subsequent restructuring of domestic and foreign debt.

Comments