Blue Gold, a prominent British mining firm operating the Bogoso Prestea Mines in Ghana with plans to list on the New York Stock Exchange, is embroiled in a heated dispute with Ghana’s Minerals Commission and the Ministry of Lands and Natural Resources over the alleged illegal reassignment of mining licenses.

Despite Blue Gold providing proof of substantial financial backing, including definitive documentation from investors demonstrating over US$100 million in daily liquidity, the Minerals Commission and the outgoing Natural Resources Minister, Samuel Abu Jinapor have reportedly refused to consider the company’s existing licenses or review its documentation.

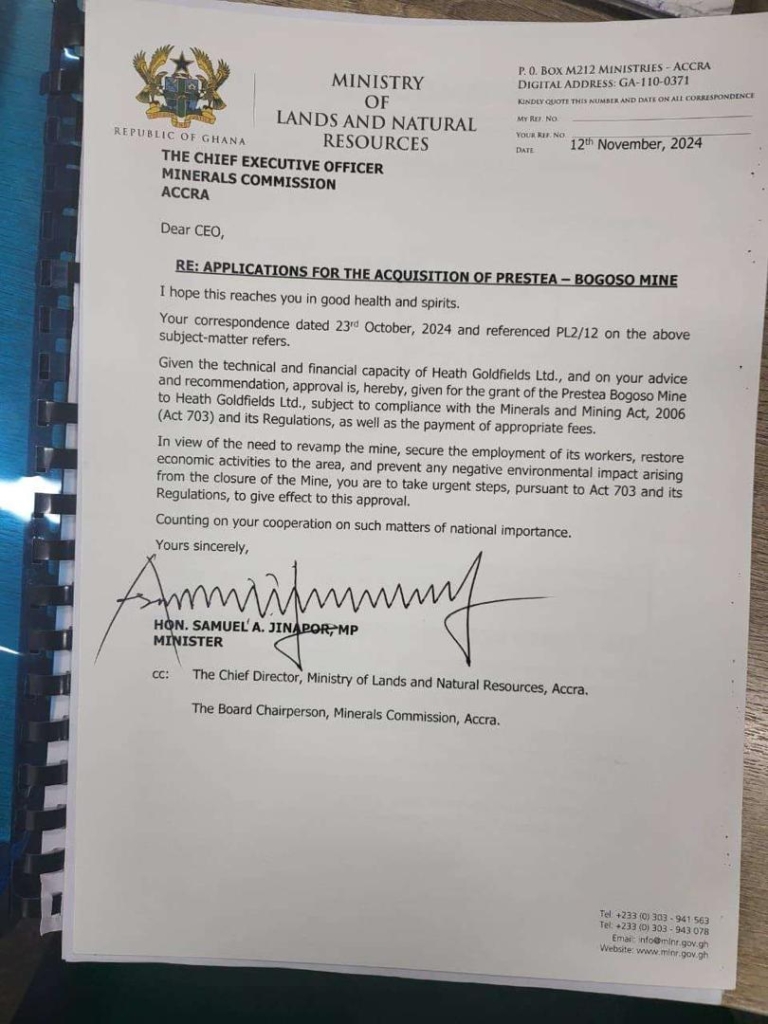

Instead, they are moving to reassign the licenses to Heath Goldfield Limited (HGL)—a company with no mining experience, a share capital of only 10,000 cedis.

Interestingly, the deal is being hatched with some National Democratic Congress (NDC) elements who want to take advantage of the incoming John Mahama administration and plunge the country into an international legal battle.

Heath Goldfields Limited (HGL), has been linked to the family of a former Ghanaian Finance Minister and has also been associated with Yıldırım Holding, a family-owned conglomerate headquartered in Turkey with companies in coal mining and shipping.

The Minerals Commission held a board meeting Wednesday, 11th December 2024, and plans to transfer the mines to Heath Goldfields Limited (HGL) and their Turkish partners, Yıldırım Holding by 12th December 2024, long before the new Mahama government takes office on 7th January 2025.

Critics argue that this move is illegal and politically motivated. Under Ghanaian law, any new mining licenses must be ratified by Parliament to be enforceable. However, with the current Parliament nearing its end, and an anticipated shift in political power to an NDC-dominated legislature, there is little chance such a decision would gain approval.

This has raised concerns that the outgoing NPP administration is using its remaining time in office to push through dubious deals benefitting party insiders.

Legal battles are already underway. Kimathi & Partners, acting on behalf of Blue Gold, is to file for an injunction to prevent the Ministry from issuing any new leases.

Additionally, Heath Goldfield Limited has been separately injuncted by Mayer Brown. Blue Gold has vowed to pursue international arbitration under the Bilateral Investment Treaty in the UK, to ensure its existing leases remain intact and effective.

The ongoing dispute has left the mine non-operational for three months, with the Minerals Commission failing to generate revenue or maintain the site, which is reportedly falling into disrepair.

Despite this, Blue Gold has continued to pay its employees and has expressed readiness to restart operations immediately, citing secured financing and investor support repeatedly ignored by the government.

This saga has intensified scrutiny on the Minerals Commission and the Ministry, with many accusing them of orchestrating a last-ditch attempt to hand over a valuable mining asset. Blue Gold’s management has emphasised that any new leases issued without parliamentary ratification are null and void, undermining the legitimacy of the government’s actions.

The case is poised to have significant implications for Ghana’s mining sector, investor confidence, and the rule of law.

Culled from The Herald Ghana

Comments