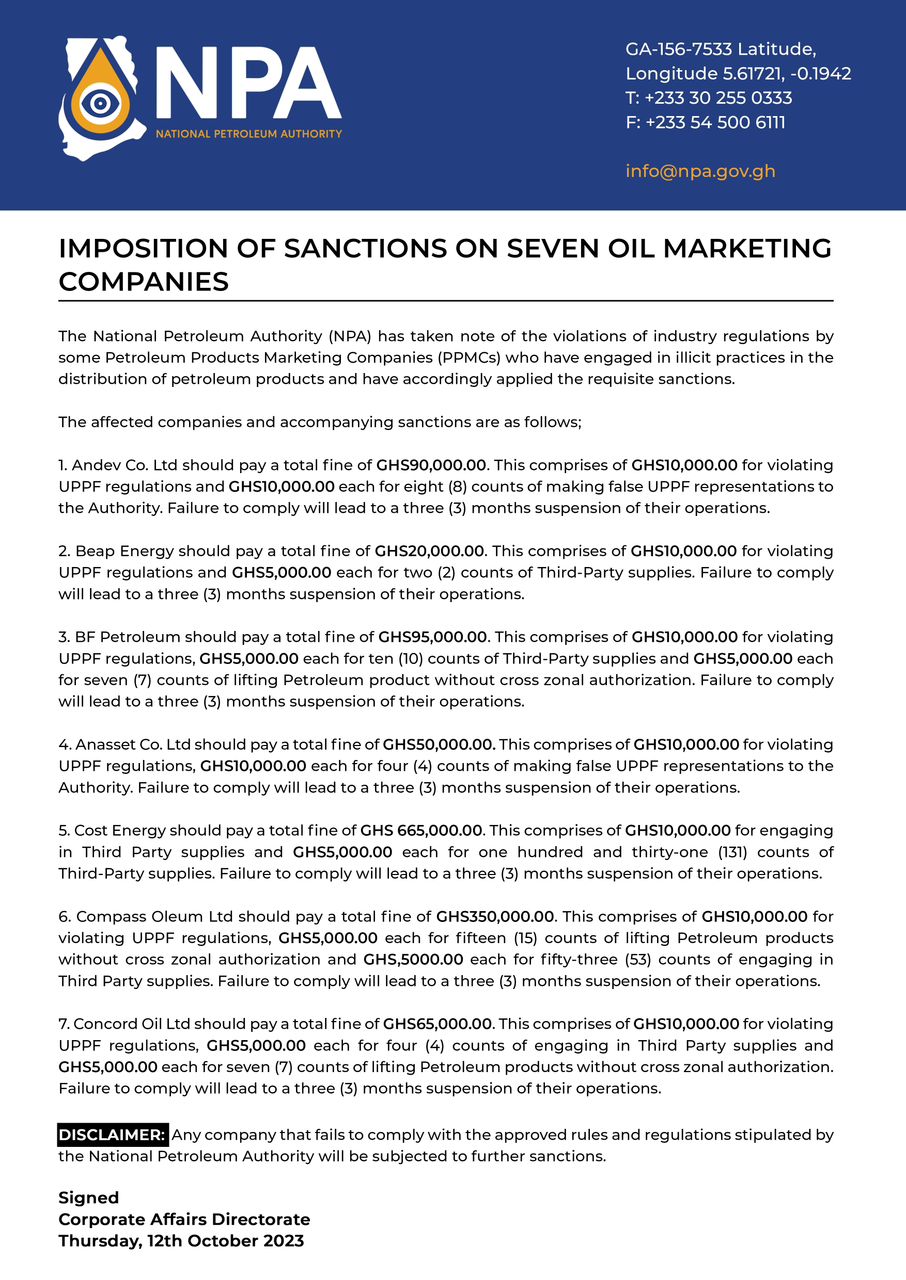

The National Petroleum Authority (NPA) has sanctioned seven Petroleum Products Marketing Companies (PPMCs) for illicit distribution of petroleum products.

They are to pay fines for violating of Unified Petroleum Pricing Fund (UPPF) regulations, making false UPPF representations to the Authority, and engaging in third-party supplies.

Failure by the affected companies to pay the fines will lead to a three-month suspension of their operations.

In the case of Andev Co. Ltd, it will pay a total fine of GHS90,000.00. This comprises GHS10,000.00 for violating UPPF regulations and GHS10,000.00 each for eight (8) counts of making false UPPF representations to the Authority.

Beap Energy is to pay a total fine of GHS20,000.00, comprising GHS10,000.00 for violating UPPF regulations and GHS5,000.00 each for two (2) counts of third-party supplies.

For BF Petroleum, the company will pay a total fine of GHS95,000.00. This constitutes GHS10,000.00 for violating UPPF regulations, GHS5,000.00 each for ten (10) counts of third-party supplies and GHS5,000.00 each for seven (7) counts of lifting petroleum products without cross-zonal authorization.

Anasset Co. Ltd is to pay a total fine of GHS50,000.00. This comprises GHS10,000.00 for violating UPPF regulations, GHS10,000.00 each for four (4) counts of making false UPPF representations to the Authority.

Another company, Cost Energy is to pay a total fine of GHS 665,000.00, comprising GHS10,000.00 for engaging in third-party supplies and GHS5,000.00 each for one hundred and thirty-one (131) counts of third-party supplies.

Compass Oleum Ltd will pay a total fine of GHS350,000.00. This constitutes GHS10,000.00 for violating UPPF regulations, GHS5,000.00 each for fifteen (15) counts of lifting petroleum products without cross zonal authorization and GHS,5000.00 each for fifty-three (53) counts of engaging in Third Party supplies.

Concord Oil Ltd is to pay a total fine of GHS65,000.00. This comprises GHS10,000.00 for violating UPPF regulations, GHS5,000.00 each for four (4) counts of engaging in third-party supplies and GHS5,000.00 each for seven (7) counts of lifting Petroleum products without cross-zonal authorization.

The NPA cautioned that any company that fails to comply with the approved rules and regulations stipulated by the Authority would be subjected to further sanctions.

The UPPF ensures that prices of petroleum products are the same across the country.

Comments