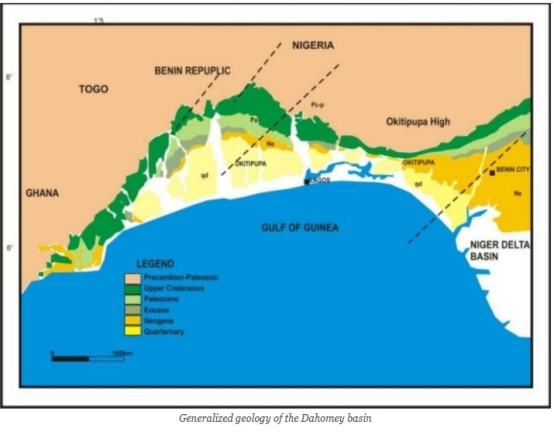

Early interest by Nigeria’s leading oil exploration firms including Lekoil Nigeria Limited in exploring the Dahomey Basin, a combination of inland and coastal offshore fields stretching from Ghana, through Togo and Benin to southwest Nigeria, has yielded a potential 5 billion barrels of oil and billions of cubic feet of gas reserves, which could turn the region into the next frontier of commercial oil exploration writes ISAAC ANYAOGU.

Two centuries ago, the name Dahomey gained notoriety for the slave trade with Europe and the eventual humiliation the Kingdom suffered when it was forced to pay tribute to the Oyo empire. Today, Dahomey is renowned as an oil patch important enough to earn Lagos State, the classification of an oil-producing state.

This happened because oil companies, especially indigenous operators, poured millions of dollars into the dream that the Nigerian sector of the Dahomey Basin covering three different states – Lagos, Ogun, and Ondo – would hold vast deposits of mineral resources. Today, oil, in commercial quantity, has been discovered there.

Geologists have always believed that the Dahomey basin holds prospects for mineral exploration based on analysis of similar basins. Exploration activities in the Nigerian end of the Dahomey Basin date back to 1903 when the survey of the mineral deposits of the Protectorate of Southern Nigeria was authorised by the Secretary of State for the Colonies. Results published in 1907 confirmed the occurrence of mineral deposits of economic importance, according to a report in the Scottish Geographical Magazine.

Some experts say the bituminous deposits are petroleum oil that has crept up-dip from the Niger Delta. Suitable hydrocarbon trapping mechanisms exist within the basin but are mostly deep offshore. Also, due to its proximity to the Niger Delta as it is separated from the region by the Okitipupa ridge, the prospect for oil find was very high. All that was required was investors with an appetite for risk.

Investors Enter

In 1997, Yinka Folawiyo Petroleum Company Limited started oil exploration activities in the basin, along with the likes of Panoro Energy Limited. Other entities that invested heavily in Dahomey Basin as partners include First Hydrocarbon Nigeria Limited and Century Energy Services Limited. With their area of work regarding OML 113, they laid the groundwork for deep exploration.

Apart from the aforementioned oil firms, Afren, from which company Lekoil substantially increased its investment, is another company also played an important role in the development of the basin for several years. Chevron was another player, being the technical operator of OML 113, the very block hosting the Aje field, before divesting in 2011.

But Lekoil and its partners took the field development a notch higher. In 2013, they invested $50 million in drilling an appraisal well and sidetrack targeting Eko, Agege, and the Syn-rift prospects. This resulted in the discovery of significant residue in the Ogo prospect, leading to the production of 770 million barrels.

According to Lekan Akinyanmi, the company’s CEO, more investments would pour into Nigeria’s oil sector under business-friendly rules as Nigeria and Africa were under-explored. This is largely due to uncertain regulatory and fiscal rules. He said fiscal terms priced based on existing production would remain unattractive for exploration.

The way to make exploration attractive in Nigeria is through competitive terms backed by assurances of contract sanctity. Altering contracts midway, especially after a major discovery like the Dahomey Basin, does not encourage investment, he said.

Lekoil ramps up investments

Lekoil Nigeria Limited has four assets (OPL 310 being its flagship) which bear both oil and gas. The OPL 310 asset is offshore Lagos, barely 20 kilometres from Nigeria’s hub of commercial activities, and contains the Ogo discovery, which is the largest in Nigeria.

Lekoil has a 62 percent shareholding in OPL 325, an exploration block of approximately 100 kilometres south of Lagos. While it is yet to drill the block, the company has access to 3D seismic data of over 740 km of oil deposit. A preliminary review of the prospects suggests oil in volumes of up to 5.7 billion barrels with an estimated 2 billion barrels recoverable based on analogues.

Lekoil’s third asset is the Otakikpo marginal field, which is a producing field delivering 6,000 barrels per day (bpd). The asset was discovered in 2014 and was brought into production within two years. Three wells drilled in the field encountered hydrocarbons at multiple intervals. 2D and 3D seismic analysis revealed reserve estimates considerably in excess of those available at the time of acquisition in May 2014.

Further seeing a pathway to driving drilling in the Dahomey Basin mainstream, Lekoil increased its interest in the concession to 40 percent, following the acquisition of one of its licences from Afren Oil and Gas in 2015.

The discovery of oil in the Ogo-1 well opens up a new oil basin in an under-explored region and represents a possible extension of the Cretaceous play along the West African Transform Margin. The discovery is a clear validation of Lekoil’s technical analysis and of our extensive studies on the Dahomey Basin,” Akinyanmi said in an interview with BusinessDay.

Lekoil’s asset also includes OPL 276 where the company has a 45 percent participating interest. The asset was acquired in 2019. Historically, four wells have been drilled in the license area, resulting in four discoveries (two oil and two gas) with preliminary resource estimates of gross recoverable volumes of 29 million barrels of oil and 333 Bcf of gas, with upside of 33 million barrels of oil and 476 Bcf of gas (recoverable). Lekoil is still waiting to renew the license on the asset to start working on the block.

Vast prospects

For the Dahomey Basin, the main prospects are in water depths ranging from 100 m to 800 m and are within the proximity of West Africa Gas. Based on data from the vertical and sidetrack wells, revised estimates for the P50 gross recoverable resources attributable to Lekoil from the Ogo field were identified as being 232 mmboe (P50) from gross recoverable resources of 774 mmboe. This far exceeds the expected pre-drill estimate of 202 mmboe. Additionally, Seismic tests show OPL 310 are expected to contain light oil or condensate-rich gas and well appraisal is expected to commence soon.

Lekoil’s drilling efforts in the Dahomey Basin, through both the OPL 310 and OPL 325, followed the acquisition of substantial shareholding. Efforts on OPL 325 gathered pace with the completion of a Technical Evaluation Report of the block located 50km south of OPL310. According to Lumina Geophysical, an oil and gas resource, a geophysical evaluation of approximately 800 sq km of 3D seismic data identified and reported a total of eleven prospects and leads on the block. This was estimated to contain potential gross aggregate Oil-in-Place volumes of over 5,700 mmbbls.

Encouraged by the results, further readings were done along the expansive 740km block and a preliminary review of the prospects, and Lumina projects oil in volumes of up to 5.7 billion barrels with an estimated 2 billion barrels recoverable based on analogues.

The gas reserve alone at the OPL 310 block boasts of a substantial gas deposit with the capacity to produce 20 percent of Nigeria’s power generation.

In 2019, the Nigerian Federal Government extended Lekoil’s OPL 310 License for three years. The company paid the extension fee of US$7.5 million on behalf of holders of the License, receiving confirmation for an extended period to 2 August 2022. In line with the data gathered from the two wells, the partners expected a 2P gross recoverable resource at 774 Mmboe throughout the Ogo prospect’s four-way dip-closed and syn-rift structure.

This independent report underlines our belief in the prospectivity of this asset that was part of our original Dahomey Basin study. The deep water turbidite fan play is particularly exciting for OPL325. As one of LEKOIL’s key assets, we are delighted to have third-party endorsement of our prospective resources, and our significant equity holding in the block gives us plenty of optionality for the next phases of exploration,” Akinyanmi said.

But the Dahomey Basin has not enjoyed the kind of attention paid to the Niger Delta, despite being the first location known to contain oil in commercial quantities in Nigeria apart from the Niger Delta. Experts say little recorded success in other countries sharing the basin may account for this. Related fields including Keita Basin in Ghana and those in Togo and Ivory Coast haven’t been truly explored.

Lekoil is betting that its investments worth millions of dollars in studies, field assessments, and working with regulatory agencies on approvals for the basin into prominence in Nigeria’s oil and gas sector, paving the way for consistent wealth and shared prosperity for Nigerians in general and Lagos in particular.

The company said it has invested around $200 million in the Dahomey Basin, from a projected $1billion helping to make the basin more attractive. For the people of Badagry, who have mainly lived off the fringes of benefits, a dawn awaits as they can begin to look forward to benefits as part of oil-producing communities.

Analysts say the onus now rests on the Lagos State Government to ensure its fortunes are dissimilar to what has been the lot of many such communities in the Niger Delta. The rising challenge of insecurity and smuggling across the Seme border is also there for Lagos State to tackle, as well as forming a synergy that helps investors get appreciable returns on investments.

credit: businessday.ng

Comments