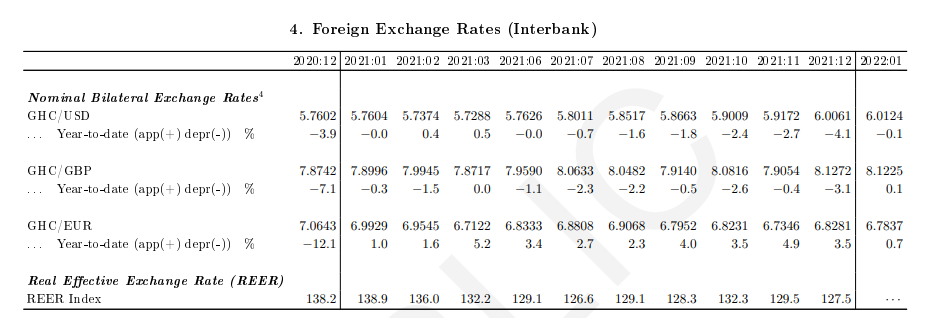

The cedi throughout last year appreciated against the Euro recording it’s highest appreciation rate of 4.9% in November.

The cedi’s appreciation rate against the Euro however reduced slightly in the last month of 2021 as it posted a 3.5% rate of appreciation to the Euro.

Against the American greenbuck, the local currency ended 2021 with a depreciation rate of 4.1%.

The recorded 4.1% end-year depreciation rate per data provided in the Bank of Ghana’s January 2022 Summary of Economic and Financial Data report, translates into an exchange rate of GHS 6.01 to the dollar.

Data provided in the report indicate that the fall of the cedi against the dollar begun at the start of the second half of 2021 when it depreciated by some 0.7% against the dollar.

This was after months of slight appreciation of the cedi against the world’s strongest currency for the first quarter of 2021.

According to the report, the cedi as at the end of Q1 2021, had appreciated by 0.5% against the dollar after which it was downhill for the local currency.

Read also: Cost of credit falls marginally, as average lending rate pegged at 20.51% – BoG

Recording a 0.7% depreciation against the dollar in July 2021, the rate of depreciation against the dollar picked-up with the cedi depreciating by 1.8%, 2.7% and finally 4.1% in September, November and December respectively.

The depreciation of the cedi is despite strong dollar reserves held by the Bank of Ghana (BoG) and the weekly forex auction of dollars by the Central Bank aimed at ensuring that there is sufficient supply of dollars to businesses and hence less pressure on the cedi which usually result in the depreciation of the local currency.

In almost a similar fashion to the Euro, the cedi throughout the year depreciated against the Pound Sterling.

The cedi ended 2021 with a depreciation rate of 3.1% to the Pound Sterling, having increased gradually from -0.3% in January 2021 to -2.3% in July and finally -3.1% in December 2021.

Meanwhile for the first month of 2022, the cedi’s depreciation rate against the dollar has been pegged at -0.1%.

It has however, appreciated against the pound and euro by 0.1% and 0.7% respectively.

Comments