China’s Finance Minister, Liu Kun, says his country has confidence in the management of the Ghanaian economy, and that his country would help Ghana seek debt servicing relief.

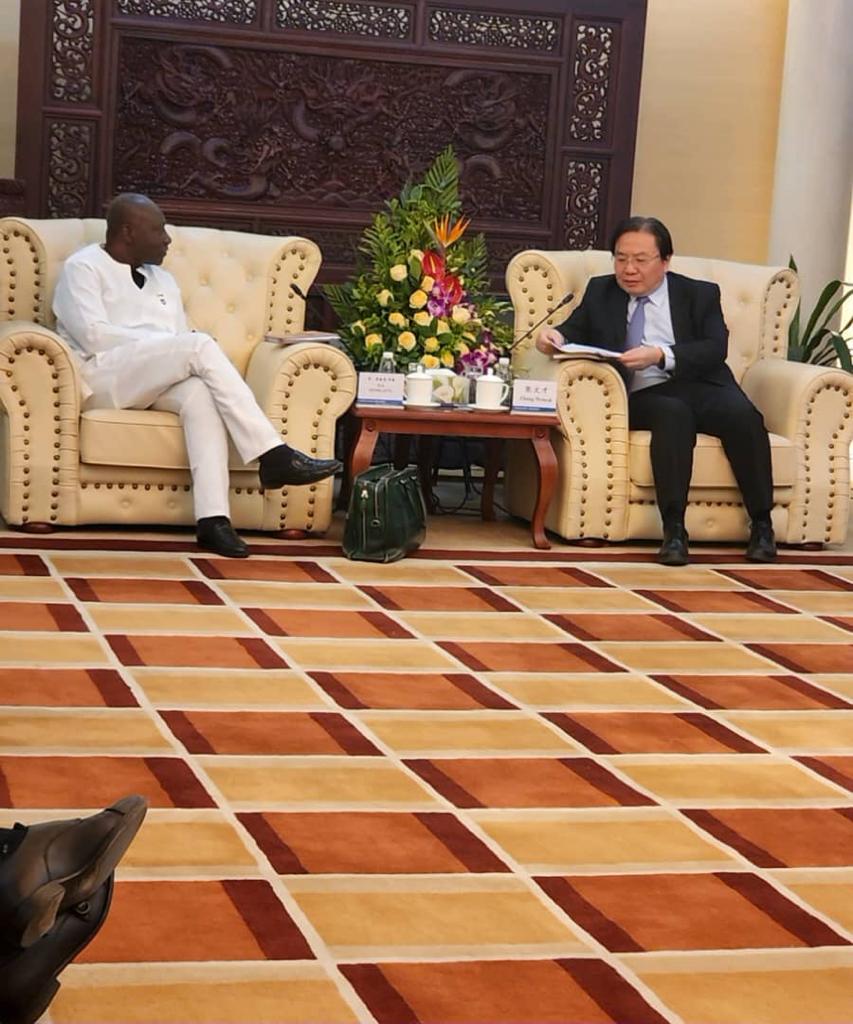

At a meeting in Beijing with Ghana’s Finance Minister, Ken Ofori-Atta, last week, Kun said the Chinese authorities “have confidence in Ghana’s economic management and its long term economic viability.”

Kun said he wanted to ensure that Ghana’s external debt treatment request was considered expeditiously and was thus accompanied to the meeting with Mr. Ofori-Atta by a high-level delegation including Mr. Wu Fuli, Chairman of China Exim-Bank.

Minister Kun said “we know that these are short-term challenges which we as responsible creditors, remain committed to resolving”.

The long-standing and prosperous relationship between Ghana and China imposes on us a responsibility to help,” the Chinese Finance Minister added.

He said that just like other African countries, Ghana was facing economic difficulties from a once-in-a-lifetime pandemic, geopolitical tensions and interest rates hike in advanced countries with a spillover effect on developing countries.

This week, all eyes are on Ghana’s parliament which will consider three key revenue measures whose approval is expected to rake in ¢4.4 billion in domestic revenues. It is one of the major actions on the part of Ghana, critical to trigger IMF Executive Board approval of a $3 billion dollar facility for the country to ease its current economic difficulties.

The Chinese officials have expressed commitment to help Ghana resolve the current short-term liquidity challenges and continue to support Ghana’s medium and long-term development aspirations.

They said China believed in promoting debt sustainability and sustainable development and would advocate for more concessional and grant funding for Ghana, especially at this time.

Ghana needs more concessional and grant fund from creditors,” said Mr. Zhang Wencai, Vice President of China Exim bank, adding that “the Multilateral Banks should therefore do more for Ghana.”

Ofori-Atta congratulated Liu Kun on his reappointment as Minister for Finance following the recently-ended National People’s Congress and thanked the Chinese authorities for participating in the G20 Creditor Committee meeting on Tuesday March 21, 2023.

He indicated that this was a sign of China’s show of leadership in the global financial ecosystem, and an affirmation of their support for Ghana.

Other Chinese officials who met Mr. Ofori-Atta were Deng Li, Vice Minister of Foreign Affairs; Li Fei, Vice Minister of Commerce; Wang Weidong of the China Development Bank (CDB), Yang Haitao, General Manager of the International Commercial Bank of China (ICBC), and Luo Zhaohui, Chairman of the China International Development Cooperation Agency (CIDCA).

Ghana makes significant progress in negotiations for debt treatment

Ofori-Atta said Ghana had made significant progress in its negotiations for debt treatment with the Paris Club and other bilateral creditors, under the G20 Common Framework.

The Paris Club had therefore agreed to form the Official Creditor Committee and deliver financing assurances to the IMF soon in order to clear the path for its executive board’s approval of Ghana’s programme by early May.

He also requested China to Co-chair the Official Creditor Committee.

Minister Kun further stated that China would hope that Multilateral and Commercial creditors will also fully participate in the interest of burden sharing.

Comments