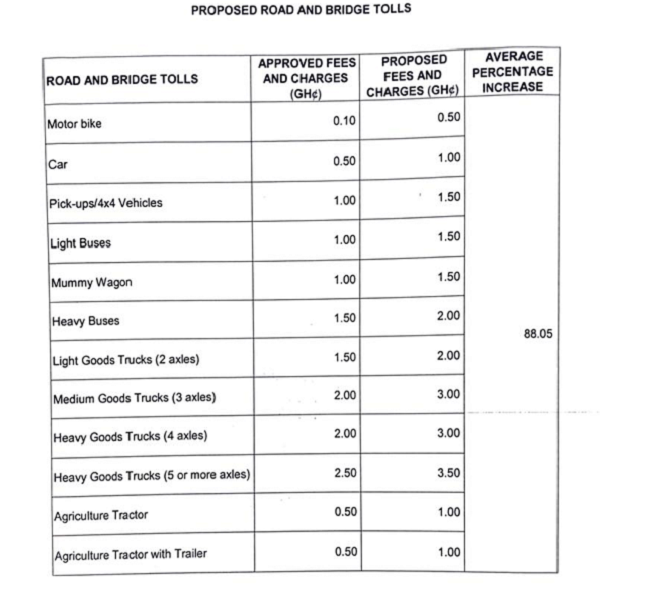

The Ministry of Finance has proposed that road tolls be increased by an average of 88 per cent as part of efforts towards ensuring a return of the levies later this year.

As part of the proposal, the ministry wants motorbikes to be levied 50pesewas compared to an earlier amount of 10pesewas.

It also wants tolls of salon cars to rise from 50esewas to GH¢1 while that of Pick-ups and 4X4 vehicles will increase to GH¢1 to GH£1.50.

Heavy buses are also to be levied GH¢2, up from the previous figure of GH¢1.50, while heavy duty trucks with five or more axles will be asked to pay GH¢3 compared to an earlier fee of GH¢2.

Fees for other categories of vehicles were also stated in a letter from the Minister of Finance, Ken Ofori-Atta, to the Minister of Roads and Highways, Kwasi Amoako-Atta, regarding the proposal. See full schedule of proposed fees attached.

It requested the inputs of the Roads and Highways Ministry “to enable this ministry to finalise the schedule of fees under the upcoming Legislative Instrument.

Mr Ofori-Atta said in the letter that the proposal was part of steps to provide foundational rates for tolling roads and highways, pending the completion of processes to identify roads and highways nationwide to be affected by the reintroduction of road tolls.

Although an age-old income generation mechanism for the state, road tolls were abolished abruptly in November 2021 after the reading of the 2022 Budget.

It led to protests by toll collectors, who said their source of livelihood was curtailed.

The Ministry of Roads and Highways then pledged to redeploy them to other areas, a pledge that the workers say was yet to be fulfilled.

The sector minister also later said the tollbooths across the country would be converted into washrooms for road users.

In the 2023 budget, however, the Finance Minister said government would work to reintroduce the levies as a revenue generation measure.

Comments