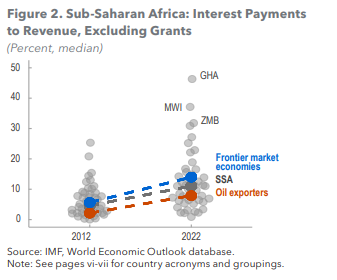

Ghana spent about 45% of its revenue excluding grants to pay interest payments in 2022, the International Monetary Fund April 2023 Regional Outlook Report has revealed.

This placed the country at the number one position in Sub-Saharan Africa.

The high interest payments was due to the elevated public debt of the country estimated at 575 billion or $44 billion as of November 2023.

Though the government suspended interest payments on some selected external debts, the interest costs of domestic debt was very high.

Now, the interest payments to be paid this year will depend on a successful external debt restructuring with its creditors – bilateral, multilateral and Euro bondholders.

This may lead to suspension of some of the interest payments or extend the maturity period.

The government in 2023 announced it was highly debt distress, leading to a debt restructuring programme.

Meanwhile, Malawi and Zambia placed 2nd and 3rd respectively in Africa with the highest interest payments in 2022.

They were expected to have spent about 37% and 31% of their revenue excluding grants to pay interest payment.

Sub-Saharan Africa’s public debt ratio at 56% of GDP reaches alarming levels

The IMF said sub-Saharan Africa’s public debt ratio at 56 percent of Gross Domestic Product in 2022—has reached levels last seen in the early 2000s.

Since the pandemic, the debt increase has been driven by widening fiscal deficits because of overlapping crises, slower growth, and exchange rate depreciations”, it added.

Furthermore, the Fund said elevated public debt levels have raised concerns about debt sustainability, with 19 of the region’s 35 low-income countries already in debt distress or facing high risk of debt distress in 2022—the same situation reported in the October 2022 Regional Economic Outlook: Sub-Saharan Africa.

Government spent ¢33.61bn on interest payments in 2021

In 2021, the government spent ¢33.61 billion on interest payments, the Bank of Ghana Monetary Policy Report disclosed.

According to the report, domestic interest payments accounted for 78.9% of the total interest payments. Total interest payments, however, constituted about 50.4% of domestic revenue.

Comments