Some firms that were expected to deploy the Electronic VAT system for prompt tax assessment by the Ghana Revenue Authority are failing to comply, more than a week after the implementation of the new system.

This according to the GRA is due to fears that many of them will be exposed, as the right tax will be collected.

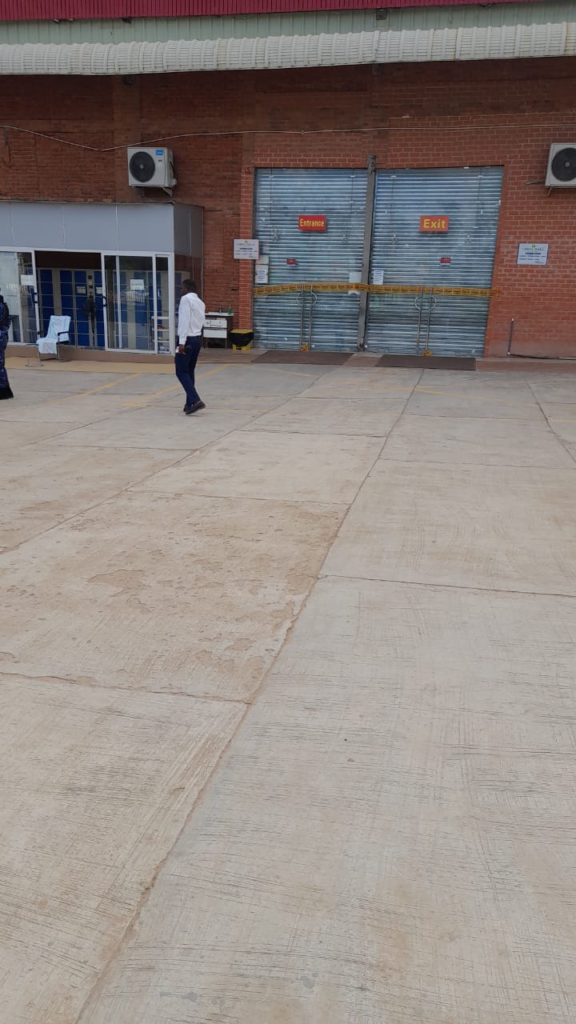

Speaking to Joy Business after an operation to close and seal the premises of China Mall, Accra Area Enforcement Manager at the Ghana Revenue Authority, Joseph Annan, said the GRA will leave no stone unturned in ensuring that the new electronic VAT system becomes successful.

“It exposes them because what you sell will definitely hit our system, so that you will be doing your thing in the shop, but we can be monitoring electronically. And as you know, many of them don’t declare all their sales so the electronic VAT system will help us get the right taxes from them”.

We shall not rest until the right thing is done because as I always say, we don’t feel comfortable going round closing shops and doing all these operations. But the citizens have paid us to work and so we shall ensure that the right thing is done”, he warned.

The Electronic VAT system began in October 1, 2022 as a measure to help the Ghana Revenue Authority block revenue loopholes.

The authority has engaged all stakeholders and selected about 50 retail centers to begin with on a pilot basis before the full implementation begins by the end of the year.

Meanwhile, the China Mall and other shopping centers remain closed until they comply with the directive of integrating their collection database with the electronic VAT system provided by the Ghana Revenue Authority.

Comments