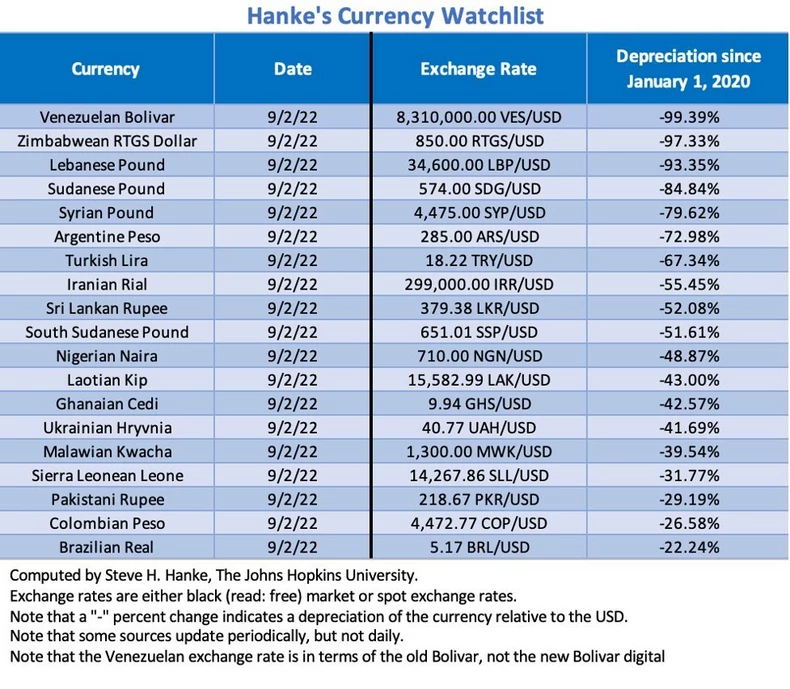

Ghana’s cedi, according to Professor Steve Hanke’s, CurrencyWatchlist, is the 5th worst-performing currency on the African Continent.

Globally, the cedi is the 13th worst-performing currency.

According to the Professor of Applied Economics and Director of the Troubled Currencies Project in the United States, the Ghanaian cedi has depreciated by 42.57% against the dollar since January 2020.

Official data from Ghana’s Central Bank puts the YTD depreciation rate of the cedi against the dollar at 35% for this year – 2022.

Professor Hanke’s currency watchlist, constitutes a group of currencies that have depreciated by at least 20% against the dollar since January 2020.

He explains that the currencies of the countries on his list have suffered massive devaluations against the US dollar since January 2020.

According to the latest ranking by Hanke’s Currency Watchlist, the Zimbabwean dollar has been rated the worst-performing currency in Africa against the United States dollar. The Zimbabwean dollar has depreciated against the USD by 97.33% since Jan. 2020.

Coming in second place is Sudan. The Sudanese pound has depreciated against the USD by 84.95% since Jan 2020. According to Hanke, the only way to save Sudan’s pound and its economy is to install a currency board.

South Sudan ranks third on the list after the nation’s currency depreciated against the USD by 50.79% since Jan 2020. According to Hanke, South Sudan’s economic death spiral never ends.

Nigeria ranks 4th on the list of worst-performing currencies in Africa and 11th globally as the currency’s value has depreciated against the USD by 48.87% since Jan 2020.

Malawi ranks 6th place in Hanke’s #CurrencyWatchlist. The kwacha has depreciated against the USD by 39.54% since Jan 2020, by measure, and is yet another central bank junk currency, said Hanke in a Twitter post.

Sierra Leone takes 7th place in Hanke’s #CurrencyWatchlist. The Sierra Leone has depreciated against the USD by 31.23% since Jan 1, 2020. According to Hanke, the country’s currency redenomination has done nothing to end its economic death spiral.

Below is Hanke’s currency watchlist:

Comments